totalira|total ira contribution limits 2023 : Cebu We would like to show you a description here but the site won’t allow us. Descarga ENHYPEN - Given-Taken. Bajar Mp3 de ENHYPEN - Given-Taken en 128kbps, 192kbps, & 320kbps, para escuchar en su telefono celular totalmente gratis sin pagar nada.ENHYPEN - Given-Taken est谩 disponible en los diferentes formatos de audio y video; MP3, ACC, M4A, MP4. est谩 disponible en los diferentes formatos de audio y .

totalira,Inspira Investment Platform. Realize the power of your self-directed IRA investments by managing your account, making trades, and more. Log in Open new account. Manage .Move money to your current 401 (k) If your current 401 (k) plan accepts rollovers from IRAs, you can consolidate your retirement savings. Move the money from your Inspira account .totaliraWe would like to show you a description here but the site won’t allow us.

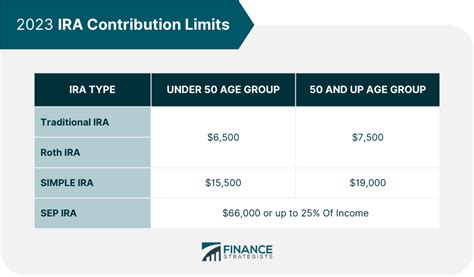

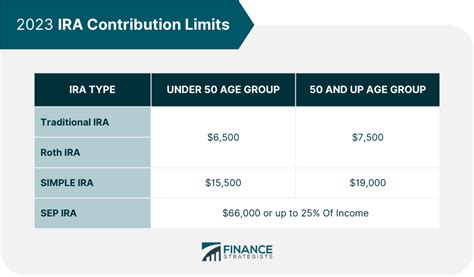

For 2023, the total IRA contribution limits are slightly higher. You can contribute up to $6,500 for the tax year or $7,500 if you're 50 years old or older. Again, if .

One of the important differences between contributing to a traditional IRA and rolling your 401 (k) balance over into an IRA is the tax treatment. When you . An IRA is a retirement savings account that provides you with tax-free investment growth and a range of other tax advantages. Anyone who earns .

El eclipse aparecerá primero sobre el océano Pacífico Sur y comenzará su recorrido por Norteamérica. La costa mexicana del Pacífico será el primer punto de . The Roth IRA contribution limits for 2023 were $6,500 or your taxable income, whichever was lower. If you were 50 or older by the end of 2023, the contribution limit was $7,500. Not everyone is . A traditional IRA is a way to save for retirement that gives you tax advantages. Generally, amounts in your traditional IRA (including earnings and gains) are not taxed .The Provisional Irish Republican Army ( Provisional IRA ), officially known as the Irish Republican Army ( IRA; Irish: Óglaigh na hÉireann) and informally known as the Provos, was an Irish republican paramilitary force that sought to end British rule in Northern Ireland, facilitate Irish reunification and bring about an independent republic .

For 2023, you are allowed to contribute 100% of your compensation up to $6,500 per year to an IRA, increasing to $7,000 in 2024. If you're aged 50 and over, you can contribute an extra $1,000 as a .

Roth IRA contribution limits 2024. Single, head of household, or married, filing separately (if you didn't live with spouse during year) Less than $146,000. $7,000 ($8,000 if 50 or older). More .totalira total ira contribution limits 2023The most you can contribute to all of your traditional and Roth IRAs is the smaller of: For 2021, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year. For 2022, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year. A traditional IRA is a retirement account in which individuals can make pre-tax contributions from their income. The value of the assets in these accounts was estimated to around 10.1 trillion U.S . The Roth IRA contribution limits for 2023 were $6,500 or your taxable income, whichever was lower. If you were 50 or older by the end of 2023, the contribution limit was $7,500. Not everyone is . IRA income limits. These income limits for traditional IRAs apply only if you (or your spouse) have a retirement plan at work. Filing status. 2023 income range. 2024 income range. Deduction limit . A traditional IRA is a way to save for retirement that gives you tax advantages. Generally, amounts in your traditional IRA (including earnings and gains) are not taxed until you take a distribution (withdrawal) from your IRA. See IRA Resources for links to videos and other information on IRAs. Publication 590-A and Publication 590-B . 6 Best IRA Accounts Of April 2024. Michael Adams. Lead Editor, Investing. Reviewed. Rae Hartley Beck. Deputy Editor of Investing and Retirement. Updated: Apr 1, 2024, 11:23am. Editorial Note: We .

total ira contribution limits 2023 Roth IRAs. A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA. You cannot deduct contributions to a Roth IRA. If you satisfy the requirements, qualified distributions are tax-free. You can make contributions to your Roth IRA after you reach age 70 ½. You can leave amounts in your Roth . One of the important differences between contributing to a traditional IRA and rolling your 401 (k) balance over into an IRA is the tax treatment. When you contribute to a traditional IRA, you may get a tax deduction for your contributions, which reduces your taxable income and tax liability. Key takeaways. The Roth IRA contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older. And for 2024, the Roth IRA contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older. Your personal Roth IRA contribution limit, or eligibility to contribute at all, is dictated by your income level.

2021. $6,000. $7,000. 2022. $6,000. $7,000. View the current and historical traditional and Roth IRA contribution limits since 2002. Learn how they are determined and how you can fund these accounts.1 | P a g e At A Glance IRA in 2022 The internal revenue allotment (IRA) is the main intergovernmental fiscal transfer in the Philippines. It is the biggest source of operating revenues of local government units (LGUs) to provide basic goods and servicesUpdated November 17, 2023. Reviewed by. Marguerita Cheng. Fact checked by Kirsten Rohrs Schmitt. The limit for annual contributions to Roth and traditional individual retirement accounts (IRAs . Roth IRA: Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 , a Roth IRA is an individual retirement plan (a type of qualified retirement plan ) that bears .Enter the result on line 1 of Form 8606. You can’t deduct the amount included on line 1. If you used the worksheet Figuring Your Reduced IRA Deduction for 2023 in Pub. 590-A, enter on line 1 of Form 8606 any nondeductible contributions from .The annual contribution limit for 2023 is $6,500, or $7,500 if you’re age 50 or older (2019, 2020, 2021, and 2022 is $6,000, or $7,000 if you're age 50 or older). The annual contribution limit for 2015, 2016, 2017 and 2018 is $5,500, or $6,500 if you're age 50 or older. Your Roth IRA contributions may also be limited based on your filing .

totalira|total ira contribution limits 2023

PH0 · total ira wmsi

PH1 · total ira log in

PH2 · total ira contribution limits 2023

PH3 · total ira contribution limits 2022

PH4 · total ira company

PH5 · total ira basis

PH6 · irs ira contributions 2021

PH7 · benefits of a traditional ira

PH8 · Iba pa